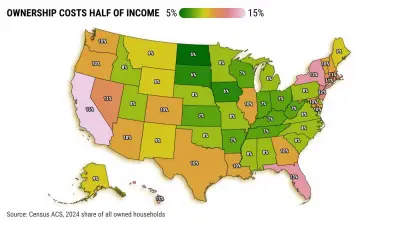

For 15% of California homeowners costs exceed half of income

Here is yet another way to look at the financial challenges of California homeownership Recurring costs eat up more than half of household income for roughly in owners statewide My trusty spreadsheet identified this affordability challenge by analyzing Census Bureau housing content for the states and the District of Columbia These latest figures detail swings in who owns their residence how much they pay a month and how a large number of owner households are financially swamped by expenses That s when mortgage payments one-third of Californians don t have a home loan plus items such as insurance utilities and association dues top of an owner s income Related Articles Bill to boost housing near transit passes But one Bay Area county got an out For of California tenants rent is more than half their income California home values drop billion to trillion of California homebuyers were investors in s first half Pro-housing nonprofits file amicus brief in advocacy of developers in Los Gatos By this math of California owners were deeply stressed in the highest share among the states and well above the nation s slice After California comes Florida New York and Hawaii at and Rhode Island at Texas was No at The nation s least-stressed owners live in North Dakota where just pay -plus Next are South Dakota and Iowa at and Indiana and West Virginia at These deeply stressed owners are a large group Despite all the economic challenges don t forget that California is the nation s largest ownership state with million living in their own home Next are Texas at million Florida at million New York at million and Pennsylvania at million Yet the high financial strains add up to million California households paying more than half their income to own also tops among the states No is Florida at then Texas at New York at and Illinois at Or look at it this way California has of the nation s million owners But the Golden State has of the million Americans who are highly burdened by ownership costs Owners remorse Ponder what it costs to own The typical Californian homeowner pays an estimated monthly above the national norm Only D C is costlier at a month After California comes New Jersey at Massachusetts at and Hawaii at The cheapest places to own are West Virginia at Arkansas and Mississippi at Kentucky at and Alabama at Texas was No at and Florida No at These costs have soared since coronavirus upended the economic activity Yes the pandemic era s once historically low mortgage rates offered major savings to numerous owners Other expenses such as property taxes and insurance have since skyrocketed across the nation Costs rose for all California owners since However that jump was just the th largest among the states and equaled the nation s five-year expense leap Florida had the largest increase at then Colorado Utah and Texas at and Oklahoma at Smallest cost gains New Jersey at Connecticut and Vermont at Delaware at and Hawaii at Renters plight Contrast owners to renters Statewide of California tenants pay -plus of their income for rent That slice is topped only by Florida s and equals Nevada s share Their distress levels are not far above the nation s share California s median costs for all renters ran a month that s above the nation s and the largest expense among the states Since California tenants have seen their expenses jump Jonathan Lansner is the business columnist for the Southern California News Group He can be reached at jlansner scng com